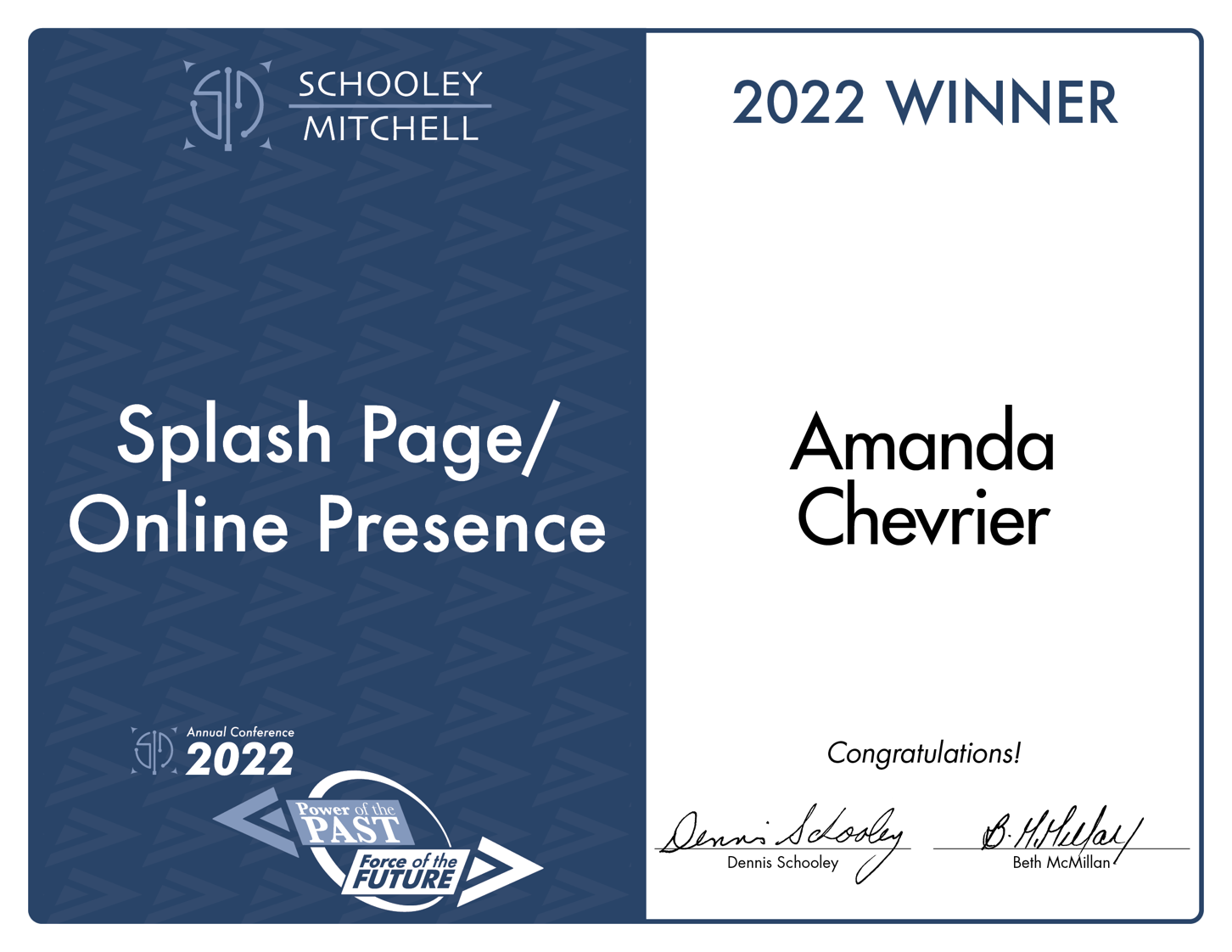

Award Recipient, Schooley Mitchell Annual Conference 2022

On behalf of all of Schooley Mitchell, we’d like to extend a huge congratulations to Kris Arnheim on receiving our award for Good News Contribution. Thank you for all your hard work this past year!